by Tang L, Wang P, Graedel T E

Resources, Conservation and Recycling, 2020, 158: 104829.

https://doi.org/10.1016/j.resconrec.2020.104829.

Highlights

The tungsten cycle in China from 1949 –2017 has been quantified for the first time.

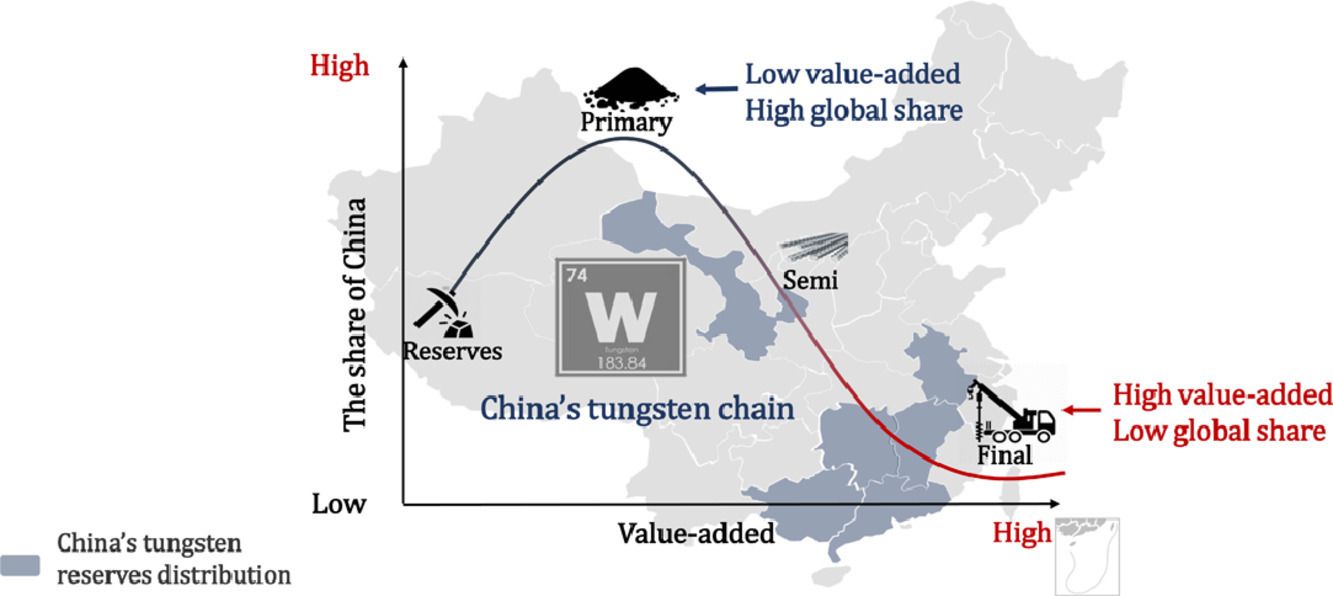

China's tungsten dominance only exists in low value-added products which face over-capacity issues.

China's future tungsten supply will be constrained by the declining tungsten ore quality.

China is a net-exporter of tungsten products, but has high dependence on tech-intensive tungsten products from other nations.

Abstract

Tungsten is deemed a critical raw material by many nations, given its irreplaceable use in industrial and military applications. In particular, much concern has been drawn to China's high share in global tungsten supply. While various studies have focused on the criticality of tungsten, few have specifically explored how tungsten is produced, consumed, and traded. In this paper, the dynamic material flow analysis is applied to quantify China's annual tungsten cycle from 1949 – 2017. It is estimated that total tungsten mined from ores in China over the past 68-year period is ~2500 kilo-tons (kt). Among those, ~750 kt of tungsten has been exported to other countries, and around 970 kt tungsten is domestically consumed. It is noted ≈1720 kt has been lost from mining, production, and end-of-life stage, and merely ~130 kt has been recycled as end-of-life scrap. Our material flow analysis further refined China's tungsten dominance. Although China currently dominates the global production of tungsten, this dominance will not extend too far into the future given China's limited share of world tungsten reserves and its declining ore quality. Our trade flow analysis reveals that China imported ~35 kt of high value-added downstream tungsten products from outside manufacturers, whose mineral resource was originally imported from China. At present, China by itself is experiencing overcapacity issues in the primary production, which discourages the recycling of at end-of-life (EoL) stage and makes the EoL recycling rate only 10%. It is noted that the percentage of Chinese tungsten for domestic consumption has been increasing in the past few years. This highlights the need for systematic measures from stakeholders along the tungsten cycle to promote sustainable practices for efficient tungsten production, use, and recycling in China. Meanwhile, the results also suggest the importance of monitoring the criticality of tungsten and other critical minerals from a dynamic and material cycle perspective.

Keywords

Tungsten;Material flow analysisIndustrial ecologyCritical materialsMaterial-energy nexus